2024 Ira Contribution Limits Spouse Deduction. Ira contribution limit increased for 2024. However, when you're a married couple filing jointly, and either you or your spouse contributes to a 401 (k) or another retirement plan at work, the deductibility of your.

$7,000 a year for individuals under age 50 as of the end of the year and. These limits depend on your income and whether you (or your spouse, if applicable) are covered by a retirement plan at work.

2024 Ira Contribution Limits Spouse Deduction Images References :

Source: brenbcharlot.pages.dev

Source: brenbcharlot.pages.dev

2024 Ira Contribution Limits Spouse Andree Atalanta, Subtract from the amount in (1):

Source: deviphyllis.pages.dev

Source: deviphyllis.pages.dev

Spouse Roth Ira Contribution Limits 2024 Sella Felisha, Traditional ira contributions are deductible but the amount you can deduct may be reduced or eliminated if you or your spouse is covered by a retirement plan at work.

Source: brenbcharlot.pages.dev

Source: brenbcharlot.pages.dev

2024 Ira Contribution Limits Spouse Andree Atalanta, If you’re married and filing separately, you receive a partial deduction if your income is up to $10,000 but no deduction if it’s equal to or exceeds $10,000.

Source: cyndiaemlynne.pages.dev

Source: cyndiaemlynne.pages.dev

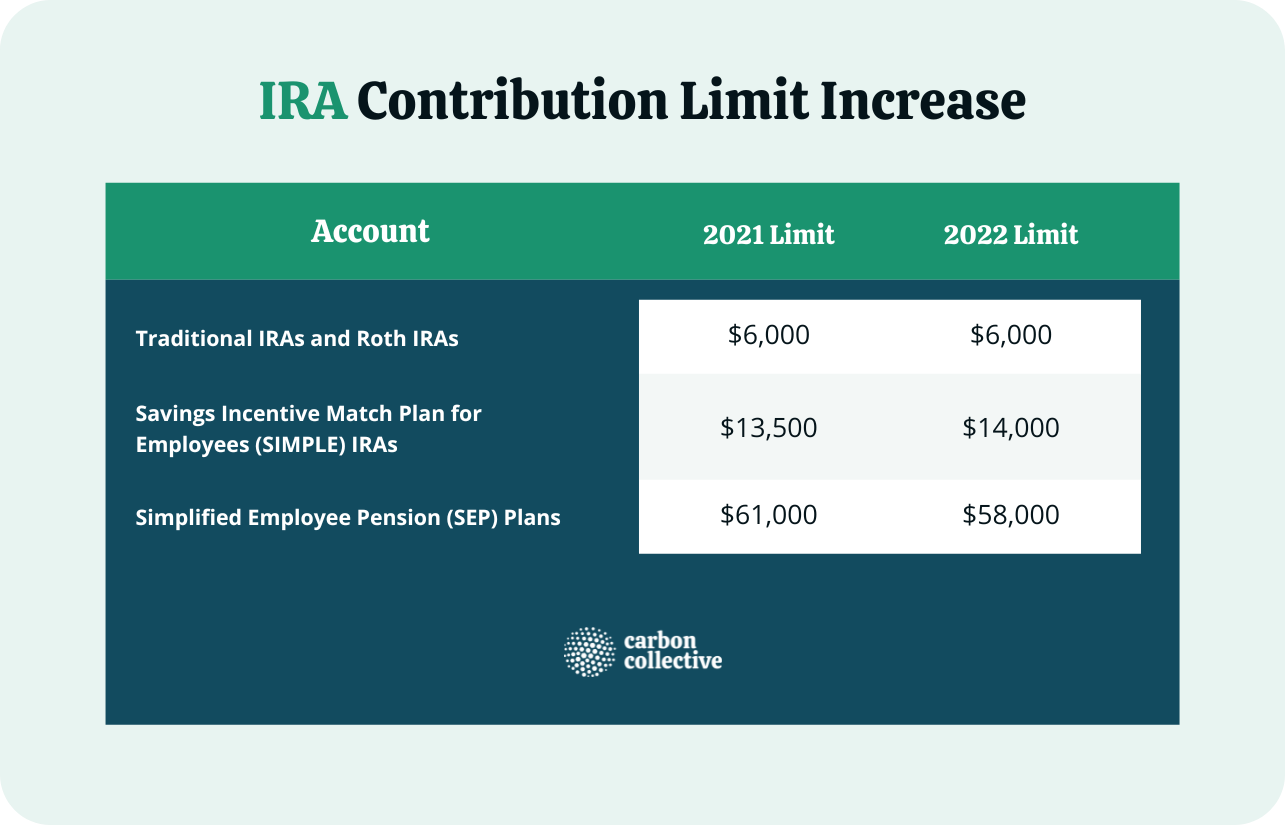

Contribution Limits 2024 Multiple Ira Funds Damara Josephine, For 2023, the limit is $6,500.

Source: kimbsusanna.pages.dev

Source: kimbsusanna.pages.dev

2024 Ira Contributions Mella Siobhan, Ira contribution limit increased for 2024.

Source: brenbcharlot.pages.dev

Source: brenbcharlot.pages.dev

2024 Ira Contribution Limits Spouse Andree Atalanta, If you're covered by a retirement plan at work, use this table to determine if your modified agi affects the amount of your deduction.

Source: trinacathryn.pages.dev

Source: trinacathryn.pages.dev

Simple Ira Limits 2024 And 2024 Dre Nancie, $7,000 a year for individuals under age 50 as of the end of the year and.

Source: deirdrewelaine.pages.dev

Source: deirdrewelaine.pages.dev

Spousal Ira Contribution Limit 2024 Farra Jeniece, Subtract from the amount in (1):

Source: iolandewcorri.pages.dev

Source: iolandewcorri.pages.dev

2024 Limits For Ira Contributions Truda Hilliary, $7,000 per individual in 2024.

Source: bettyeqnoelyn.pages.dev

Source: bettyeqnoelyn.pages.dev

Simple Ira Contribution Limits 2024 Catch Up Becka Klarika, Ira contribution limit increased for 2024.

Posted in 2024