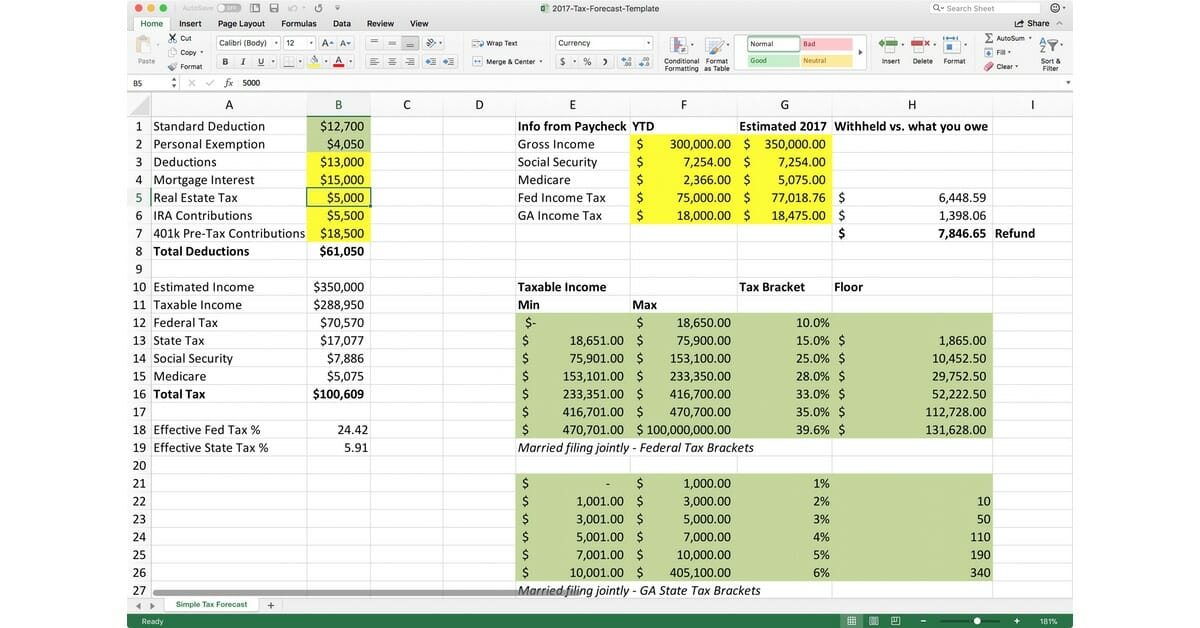

Irs Estimated Tax Payments 2024 Calculator. Use smartasset's tax return calculator to see how your income, withholdings, deductions and credits impact your tax refund or balance due amount. You pay your quarterly taxes on the 15th day following the end of the quarter.

Figuring out how much estimated tax to pay with a calculator will make tax season much easier to navigate. Add all your income types e.g.

Irs Estimated Tax Payments 2024 Calculator Images References :

Source: minettewevita.pages.dev

Source: minettewevita.pages.dev

How Do I Calculate My Estimated Taxes For 2024 Hanny Kirstin, Calculate your federal, state and local taxes.

Source: abigalewdanice.pages.dev

Source: abigalewdanice.pages.dev

Estimated Tax Payments 2024 Calculator Faunie Kathie, Feel confident with our free tax calculator that's up to date on the latest.

Source: kileysteffi.pages.dev

Source: kileysteffi.pages.dev

Estimated Tax Payments 2024 Dates Calculator Elsy Karlene, Washington — the internal revenue service today suggested taxpayers who filed or are about to file their 2022 tax return use the irs tax withholding estimator.

Source: kieleqserene.pages.dev

Source: kieleqserene.pages.dev

2024 Tax Estimated Payment Calculator Tedda Gabriell, Add all your income types e.g.

Source: eugineamelina.pages.dev

Source: eugineamelina.pages.dev

Estimated Tax Payments 2024 Irs Delay Alexia Phelia, Enter your filing status, income, deductions and credits and we will estimate your total taxes.

Source: riccadaniella.pages.dev

Source: riccadaniella.pages.dev

Irs Tax Refund Calculator 2024 Lanie Mirelle, Based on your projected tax.

Source: barriebhedvige.pages.dev

Source: barriebhedvige.pages.dev

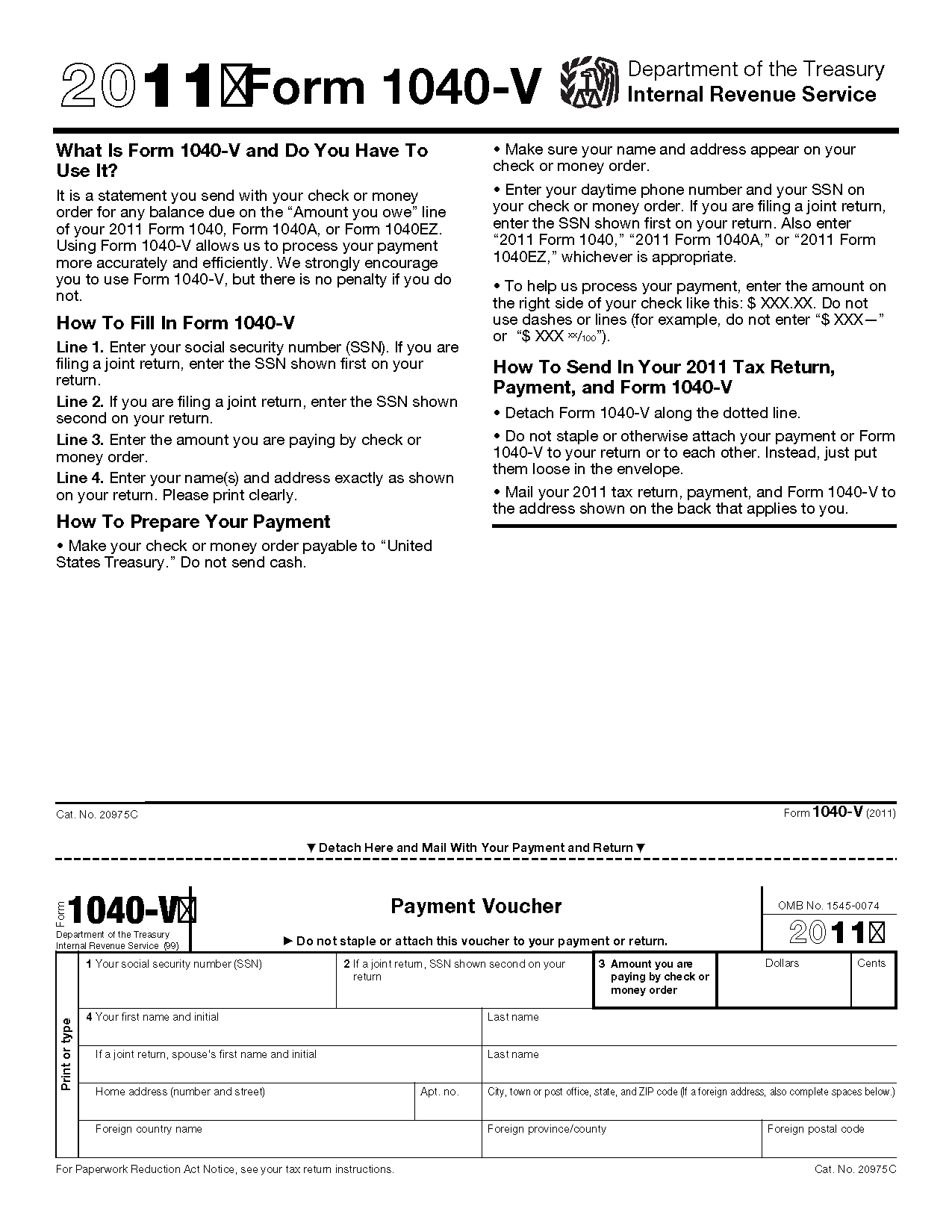

Irs Estimated Tax Payment Forms 2024 Elsi Nonnah, Estimated tax refund payments 2024 calculator use our tax return calculator to estimate your ato tax refund in seconds.

Source: carineqrosanne.pages.dev

Source: carineqrosanne.pages.dev

Irs Estimated Tax Payment Due Dates 2024 Schedule Bianca Jennifer, You pay your quarterly taxes on the 15th day following the end of the quarter.

Source: dinnieqingaborg.pages.dev

Source: dinnieqingaborg.pages.dev

Estimated Tax Due Dates 2024 Quarterly Results Sofia Eleanora, Feel confident with our free tax calculator that's up to date on the latest.

Source: ronnaqtoinette.pages.dev

Source: ronnaqtoinette.pages.dev

Estimated Tax Payments 2024 Dates Calculator Joya Rubina, No, you are not required to do anything with those estimated tax vouchers for 2024.

Posted in 2024