Maximum Retirement Contribution 2025. The update forecasts a $1,000 boost to this year’s 401 (k) elective deferral limit of $23,000, which would bring the 2025 limit to $24,000. For single coverage, the hsa contribution limit will rise from.

Limits on contributions and benefits. This is scheduled to progressively increase to 12% on 1 july 2025.

Limits On Contributions And Benefits.

This limit is per employer and includes money from all sources:.

The Update Forecasts A $1,000 Boost To This Year’s 401 (K) Elective Deferral Limit Of $23,000, Which Would Bring The 2025 Limit To $24,000.

The annual additions limit is the total amount of all the contributions you make in a calendar year.

The Total Maximum Allowable Contribution To A Defined Contribution Plan Could Rise $2,000, Going From $69,000 In 2024 To $71,000 In 2025.

Images References :

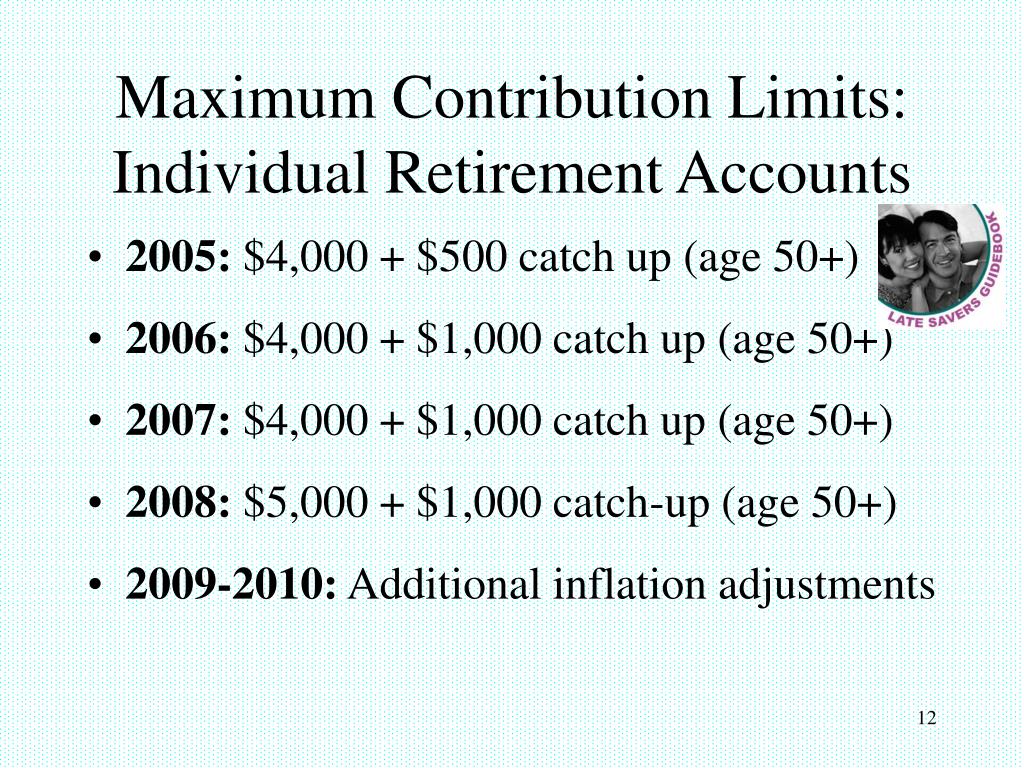

Source: www.slideserve.com

Source: www.slideserve.com

PPT Retirement Investment Strategies PowerPoint Presentation, free, If you are 50 or older, your roth ira contribution limit increases to $8,000 in. For single coverage, the hsa contribution limit will rise from.

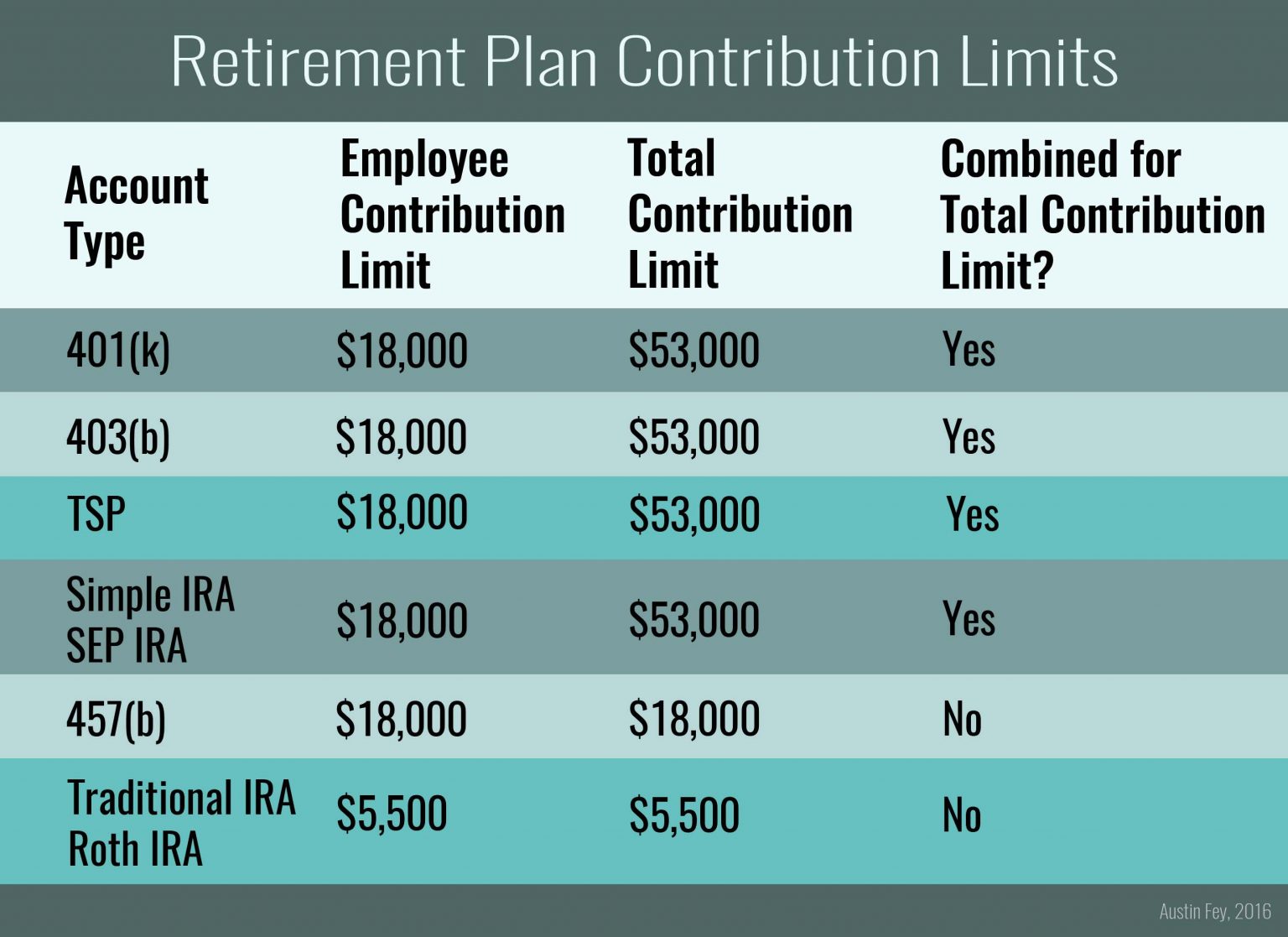

Source: www.internetvibes.net

Source: www.internetvibes.net

Choosing The Best Small Business Retirement Plan For Your Business, This is scheduled to progressively increase to 12% on 1 july 2025. For single coverage, the hsa contribution limit will rise from.

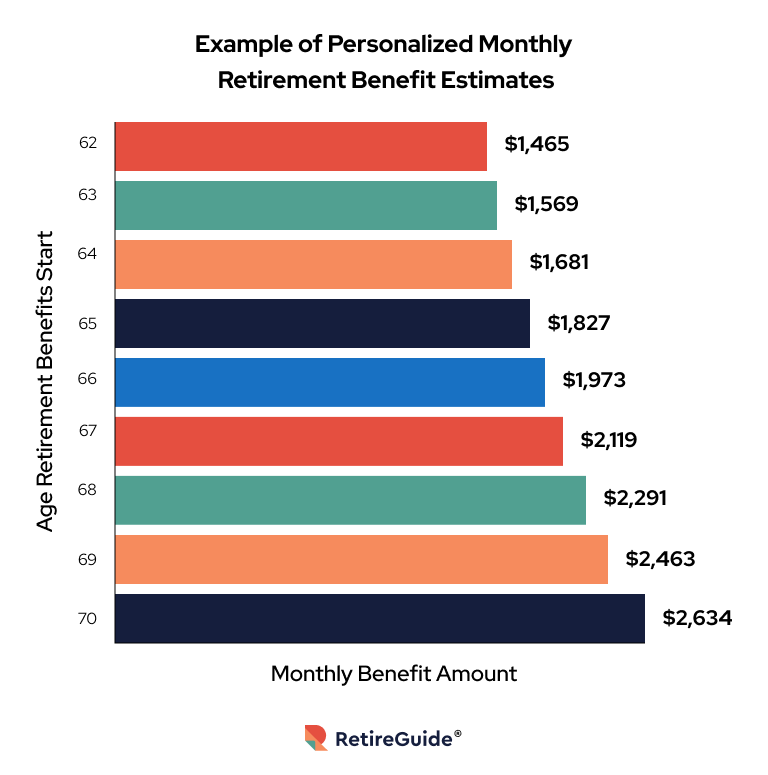

Source: www.retireguide.com

Source: www.retireguide.com

Social Security Retirement Benefits Explained, This limit is per employer and includes money from all sources:. For single coverage, the hsa contribution limit will rise from.

Source: blog.seedly.sg

Source: blog.seedly.sg

Guide to CPF LIFE Plans, Payouts, and What Happens to My CPF When I Die?, In 2025, the total contribution limit is projected to be $71,000. Make the most of your yearly opportunity to save toward.

Source: pensionspecialist.net

Source: pensionspecialist.net

Maximum Allowable Benefits/Contributions Pension Specialist, For single coverage, the hsa contribution limit will rise from. For tax year 2024 (filed by april 2025), the limit is $23,000.

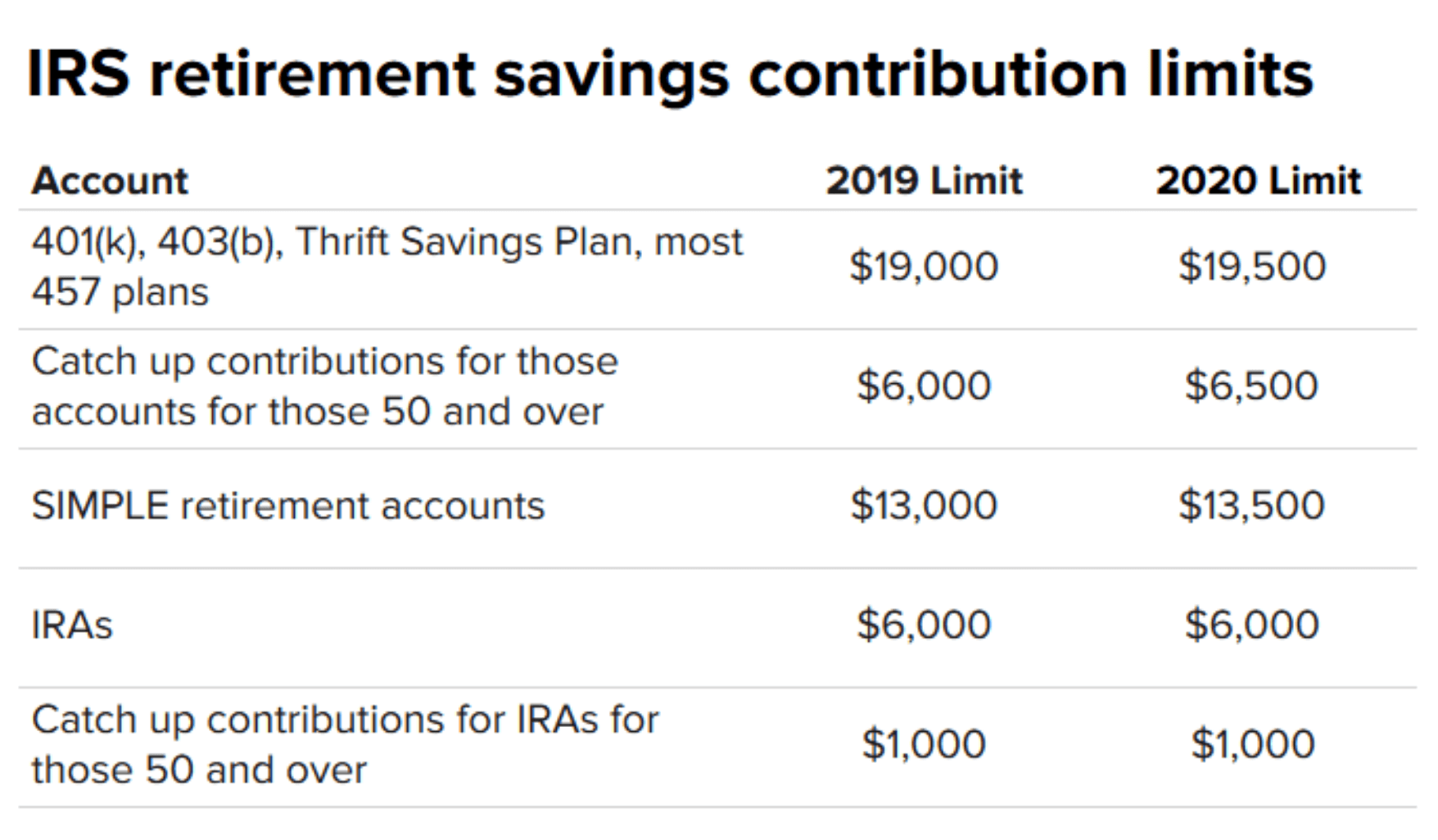

Source: alliancewealthadvisors.com

Source: alliancewealthadvisors.com

Retirement Savings Contribution Limits Alliance Wealth Advisors, The annual additions limit is the total amount of all the contributions you make in a calendar year. The total maximum allowable contribution to a defined contribution plan could rise $2,000, going from $69,000 in 2024 to $71,000 in 2025.

Source: www.shutterstock.com

Source: www.shutterstock.com

457b Contribution Limits Maximum Contributions Retirement Stock Vector, The total maximum allowable contribution to a defined contribution plan could rise $2,000, going from $69,000 in 2024 to $71,000 in 2025. From 1 july 2024, local government employees are no longer mandated to make additional contributions on top of their employer’s superannuation guarantee.

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, For 2024, you can contribute up to $7,000 to a roth ira if you're under 50. If you are 50 or older, your roth ira contribution limit increases to $8,000 in.

Source: www.fool.com

Source: www.fool.com

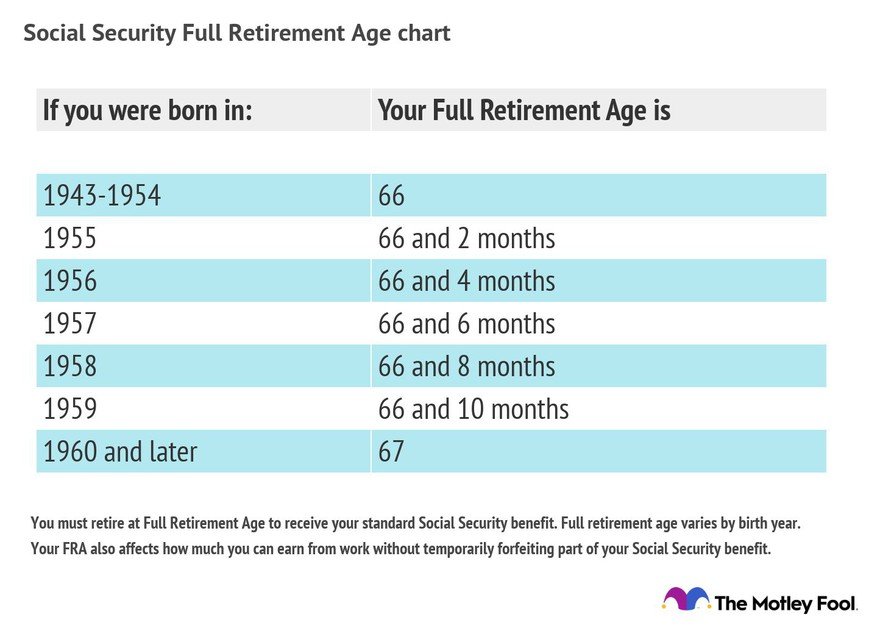

What Is My Full Retirement Age for Maximum Social Security?, In 2023, the general limit was $6,500, meaning that the irs bumped up the annual contribution maximum by $500 in 2024. Make the most of your yearly opportunity to save toward.

Source: wctpension.org

Source: wctpension.org

Normal Retirement The Western Conference of Teamsters Pension Trust, In 2023, the most you can. The annual additions limit is the total amount of all the contributions you make in a calendar year.

Secure 2.0 Increases Those Limits,.

The total maximum allowable contribution to a defined contribution plan could rise $2,000, going from $69,000 in 2024 to $71,000 in 2025.

For Single Coverage, The Hsa Contribution Limit Will Rise From.

The maximum contribution for iras and roth iras increased to $6,500, up from $6,000 in 2022.